1.0 Executive Summary

The purpose of this business plan is to raise $210,000 of equity capital and $1,000,000 of debt capital for the development of a real estate investment firm that specializes in the rental and sale of residential properties while showcasing the expected financials and operations over the next three years. The Real Estate Investment Firm, Inc. (“the Company”) is a New York based corporation that will provide real estate acquisition and rentals to tenants in its targeted market. The Company was founded by John Doe. Revenue generating operations are expected to commence later this year.

1.1 The Services

The primary revenue center for the business is acquiring properties with the intent to rent them to the general public (among middle income renters). The business will generate profits from both the ongoing rental income paid to the Real Estate Investment Firm while generating capital appreciation from the long term holding of these properties (which will be recognized within the next three to seven years).

For the first acquisition, the Company intends to acquire a 40 unit property that is currently 95% occupied. The average rent per unit is $750. The Company will acquire this property for $1.1 million (with $100,000 being used as a down payment and $1,000,000 sought as a mortgage (carrying a 5.25% interest rate and a 30 year term).

The Company will acquire additional multiunit properties in both Year 2 and Year 3. These properties will be of similar size to the first acquisition.

The third section of the business plan will further document the operations of Real Estate Investment Firm, Inc.

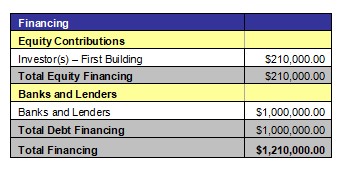

1.2 Financing

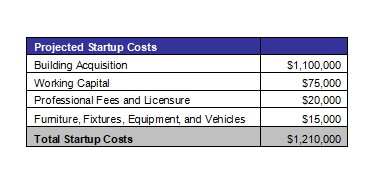

Mr. Doe is seeking to raise $210,000 from an investor. The terms, dividend payouts, and aspects of the deal are to be determined at negotiation. The business will also secure a $1,000,000 mortgage for its first acquisition. The financing will be used for the following:

- Financing to acquire the initial property

- Financing for the first six months of operation

- General furniture, fixtures, and equipment

The next section of the business plan will further document the usage of investment and borrowed funds.

1.3 Mission Statement

Mr. Doe’s mission is to develop the Real Estate Investment Firm into a premier regional real estate investment firm that will acquire and rent properties profitably.

1.4 Management Team

The Company was founded by John Doe. Mr. Doe has more than 10 years of experience in the real estate industry. Through his expertise, he will be able to bring the operations of the business to profitability within its first year of operations.

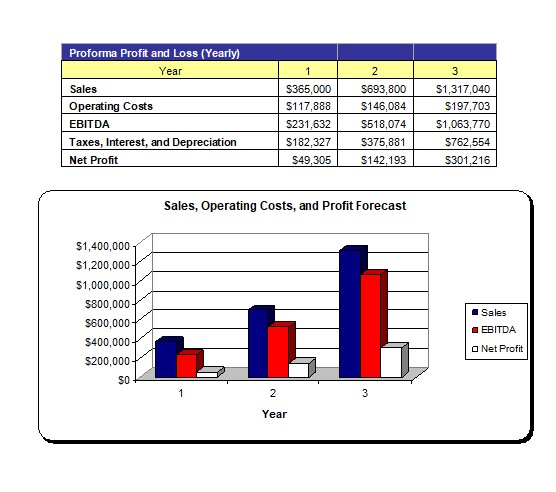

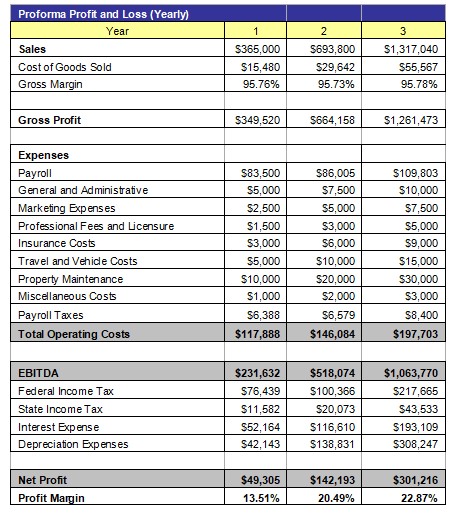

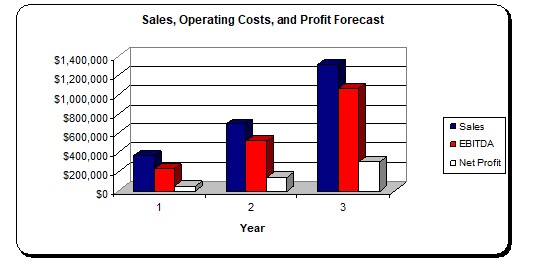

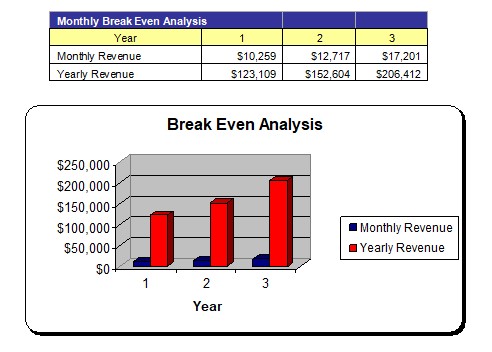

1.5 Sales Forecasts

Mr. Doe expects a strong rate of growth at the start of operations. Below are the expected financials over the next three years:

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. As the real estate market returns to normal conditions, the Real Estate Investment Firm will be an excellent position to recognize profits from the sale of properties. Over the next two years, the Company will acquire additional capital (debt and equity) in order to acquire two additional properties (one in each year).

2.0 Financing Summary

2.1 Registered Name and Corporate Structure

Real Estate Investment Firm, Inc. The Company is registered as a corporation in the State of New York.

2.2 Required Funds

At this time, the Real Estate Investment Firm requires $210,000 of equity funds and $1 million (via a mortgage). Below is a breakdown of how these funds will be used:

2.3 Investor Equity

John Doe intends to sell 50% of the Real Estate Investment Firm in exchange for the initial equity capital sought in this business plan. Subsequent capital raises for the acquisition of additional properties are expected over the next three years.

2.4 Management Equity

John Doe will retain 50% of the business once the initial capital is raised.

2.5 Exit Strategy

Mr. Doe may seek to sell the business to a third party for a significant earnings multiple or divest the properties individually. Most likely, the Company will hire a qualified real estate broker to sell the properties on behalf of the Real Estate Investment Firm (with the initially acquired properties sold over the next three to seven years).

3.0 Real Estate Operations

The direct finance and purchase of residential property is the primary business of Real Estate Investment Firm. Residential real estate will provide a continuous stream of rental income that Management will use for reinvestment and profit stability for the Company.

The first property to be acquired by the business features 40 units (with each unit having an average monthly rental fee of $750). There is also an onsite laundry room that features coin-operated washers and dryers.

Management is developing a complex economic pricing strategy that will determine the fair market rate of a property based on its capitalization rate in conjunction with the market values of residential property. Residential real estate is the least risky form of real estate investing because the service offered is a necessity.

It should be noted that the Company may seek to use syndicated equity focused capital raises over the next two years as opposed to direct investment in Real Estate Investment Firm. However, this business plan assumes that future investments will be made directly into the Company rather than the through use of limited partnerships.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

Management is developing a very complex pricing method to ensure that the Company can continue to provide its units at profit despite possible drawbacks in the overall economic market. The Company’s two prong approach to real estate will allow the business to grow successfully in the rapidly changing real estate market.

Currently, the economic climate is uncertain. The pandemic stemming from Covid-19 has created a substantial amount of turmoil within the capital markets. It is expected that a prolonged economic recession will occur given that numerous businesses are being forced to remain closed for an indefinite period of time (while concurrently having their respective employees remain at home). However, central banks around the world have taken aggressive steps in order to ensure the free flow of capital into financial institutions. This is expected to greatly blunt the economic issues that will arise from this public health matter.

However, the current economic has create a number of buying opportunities (as well as property rehabilitation opportunities) given that interest rates have declined and there are now a number of distressed properties on the market (especially among people that are selling properties due to economic reasons). As such, by sourcing capital now – the Company will be in an excellent position to acquire undervalued properties that will generate substantial capital appreciation once normalized economic growth resumes.

4.2 Real Estate Strategies

The Real Estate Investment Firm plans to actively pursue a real estate acquisition program that will focus on the purchase of multiunit apartment buildings with the intent of creating a recurring stream of income. Management will use reasonable leverage to purchase these properties so that a positive cash flow is generated after debt service has been paid.

The recurring streams of revenue generated from the rental of multi-unit residential property will allow the Company to continually recognize revenue despite drawbacks in the real estate market. As these properties increase in value through capital appreciation, the Company will divest of these properties to reap its capital gain profits.

The Company will divest its properties once Management feels that its real estate holdings have become overvalued. Mr. Doe has worked diligently to create a pricing model that will allow the business to understand when the properties have an unusually high price. This model will examine the capitalization rates of the income producing properties for a determination of true asset value.

There are tremendous tax benefits for the Company as it engages its real estate investments. As the business makes its real estate divestitures, The Company will recognize capital gains income rather than income on its properties. These windfall gains will be taxed at a rate that is significantly lower than the federal regular income tax levels.

4.3 Industry Analysis

In the United States, there are 2 million companies that operate in a real estate investment capacity by sourcing funds from private investors/banks with the intent to engage in real estate related activities. Each year, these firms aggregately generate $1 trillion per of gross revenues (including the sales of properties).

This is one of the country’s mainstay industries, and the future growth rate will mirror that of the economy in general.

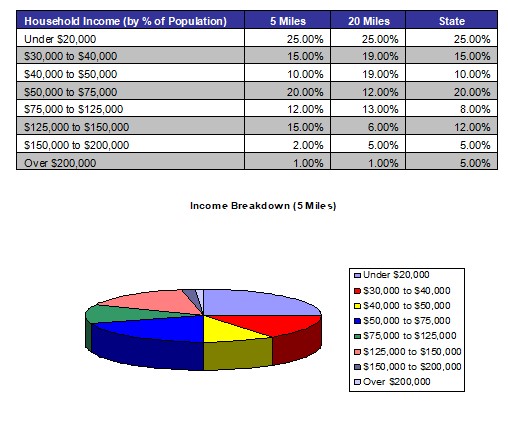

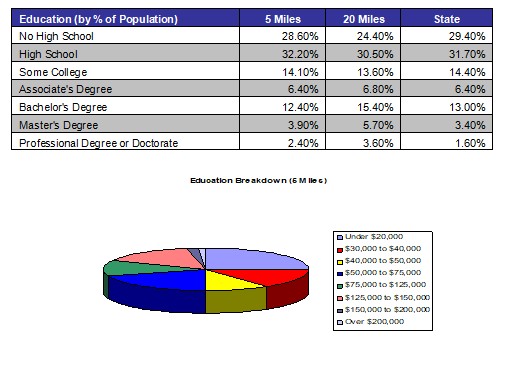

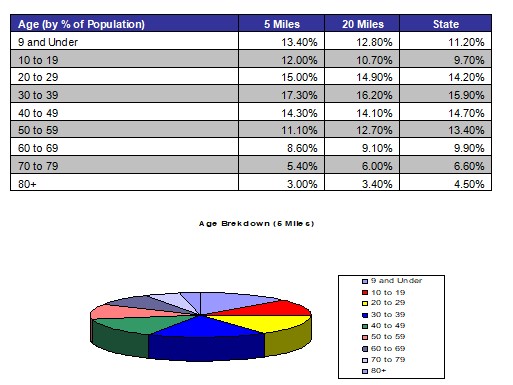

4.4 Customer Profile

As the Company intends to operate among several different investment and operating units, it is hard to characterize any specific tenant that will occupy the Company’s properties. However, Management will enact strict tenant quality and credit review procedures to ensure the Company’s revenues will not be interrupted by tenant default.

Generally, Management will use the following profile when targeting potential renters:

- Annual household income of no more than $60,000

- Will spend $750 to $1,000 on a one to two bedroom apartment

- Currently lives within 20 miles of a property owned by the Real Estate Investment Firm, Inc.

4.5 Competition

Since real estate is effectually one of the most free market oriented businesses in the country, competition can not be accurately categorized. The Company anticipates that there will be a sizable amount of competition from both single owner investment firms to large construction companies that are seeking to gain from undervalued properties in the Northeastern United States.

5.0 Marketing Plan

The Real Estate Investment Firm intends to maintain an extensive marketing campaign that will ensure maximum visibility for the acquired units in its targeted market. These marketing campaigns will also target investors that will want to place capital with the Company for investment purposes.

5.1 Marketing Objectives

- Maintain an expansive website which will include the use of social media and SEO to boost visibility.

- Develop strong connections with real estate brokers that will rent units on behalf of the Company.

- Maintain strong relationships with investors.

5.2 Marketing Strategies

Management will use a two-pronged investment strategy in order to target people that will rent properties as well as real estate investors that may want to invest capital with the Company.

As it relates to sourcing renters (for when a vacancy occurs), Management intends to use a highly qualified regional real estate brokerage that will list and show properties on behalf of the Real Estate Investment Firm. The Founder anticipates that each successfully placed renter will cost the equivalent of two months of rent. At this time, the Founder is actively building a database of real estate agents that work within the New York metropolitan area that can effectively deliver results for the business.

Beyond retaining a qualified brokerage, the business will maintain a proprietary website that showcases all properties and units that are available for rent. This online form of marketing will run concurrent to that of the Company’s retained brokers and agents’ marketing plans. This website will be heavily search engine optimized and mobile friendly.

It should be noted that videos of each property owned by the Real Estate Investment Firm will be created and uploaded to the website (via YouTube). These videos, when a vacancy occurs, will also be showcased on popular social media platforms including FaceBook and Twitter.

A substantial portion of the website will be geared towards potential ongoing investors for the Company. Access to information regarding how to invest with the Real Estate Investment Firm will be granted once a user confirms that they are a qualified or accredited investor. The link to the website will be listed among major portals that target real estate investors.

For search engine optimization, the business will retain a qualified SEO and/or web development firm in order to ensure that the Real Estate Investment Firm’s website is found when relevant searches are carried out among major search engines. The business will have its SEO firm place linking text among numerous websites that focus on real estate rentals and sales (as well as investment portals as discussed above).

From time to time, the business will list available units (for sale and for rent) among circulars within the greater New York metropolitan area. These advertisements will be placed in tandem with the print marketing that the Company’s brokerage carries out.

It should be noted that the Company has a full-scale stand alone marketing plan specific for targeting real estate investors. This document is available upon request.

6.0 Organizational Plan and Personnel Summary

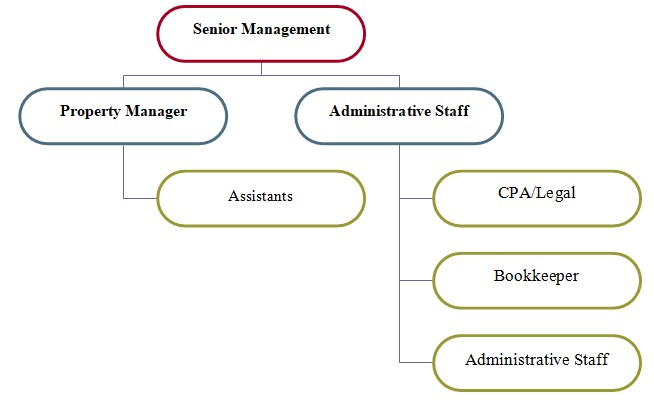

6.1 Corporate Organization

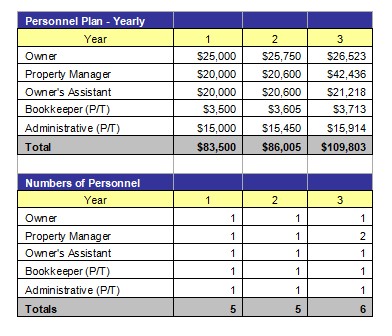

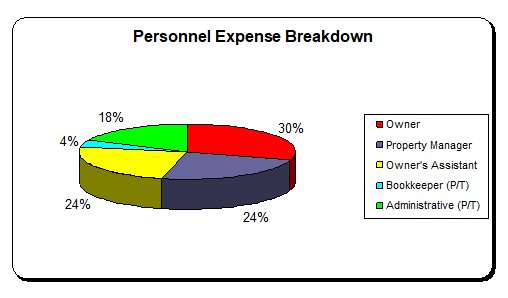

6.2 Organizational Budget

7.0 Financial Plan

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

- Real Estate Investment Firm will have an annual revenue growth rate of 37% per year.

- The Founder will acquire $210,000 of equity capital for the acquisition of the first property (which will also be financed using a $1,000,000 loan carrying a 5.25% interest rate and a 30 year term).

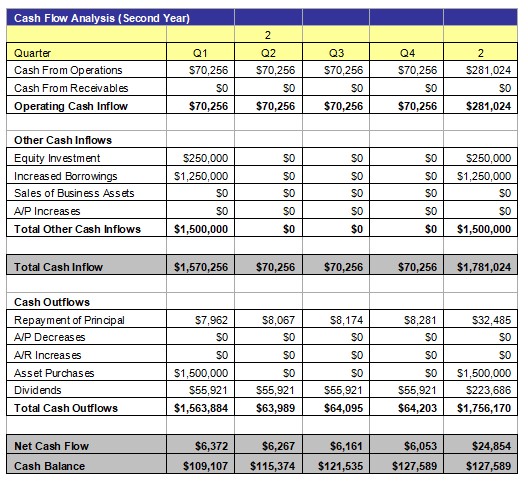

- In Year 2, an additional equity investment of $250,000 will be acquired coupled with a $1.25 million loan (with a 30 year term and a 5.25% interest rate) to acquire a second building that features 30 units (with an average monthly rental fee of $850).

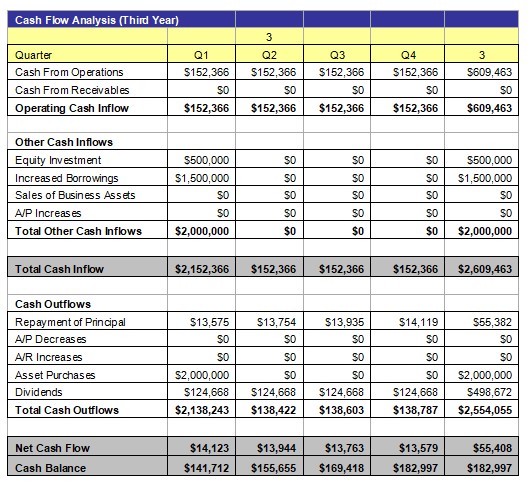

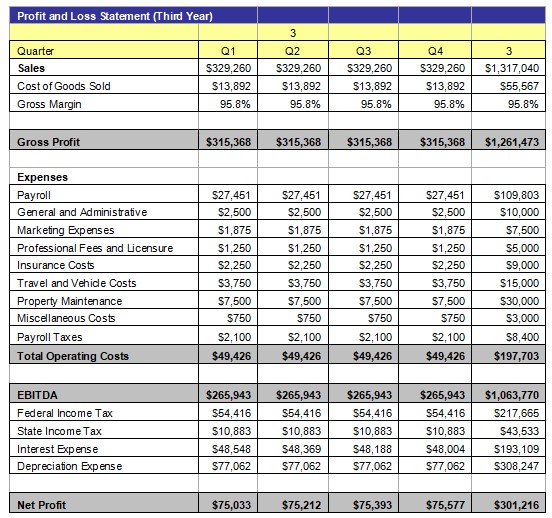

- In Year 3, the Company will secure a $500,000 investment and a $1.5 million loan (with the same terms as the other credit facilities) for the acquisition of a 50 unit building (with average per unit rental rates of $1,000 per month).

7.2 Sensitivity Analysis

The Company’s revenues can change depending on the general economic climate of the real estate industry. In times of economic recession, the Company may have issues with its top line income as fewer sales will be made and rental income may decrease. However, the Company will generate income from its rental business (which will always remain as its primary source of revenue), which will reduce the risks associated with this business.

7.3 Source of Funds

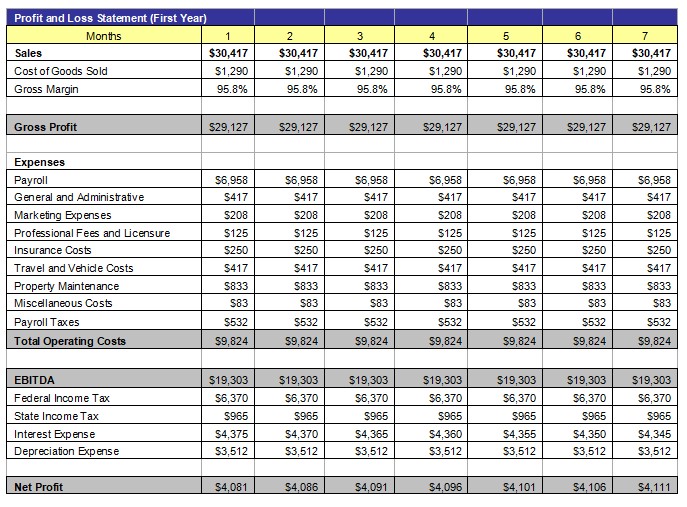

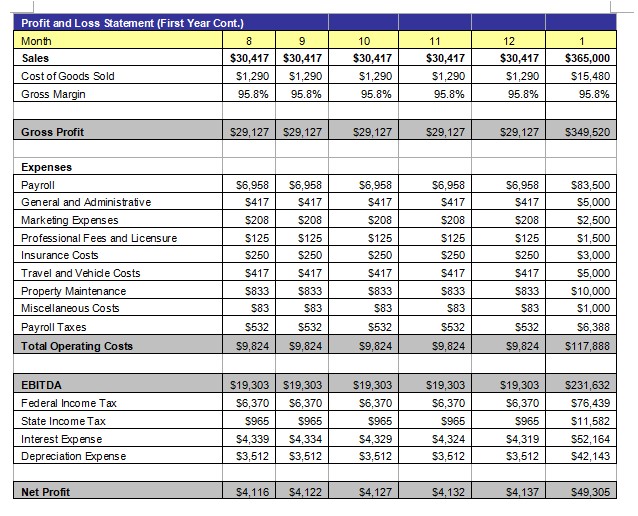

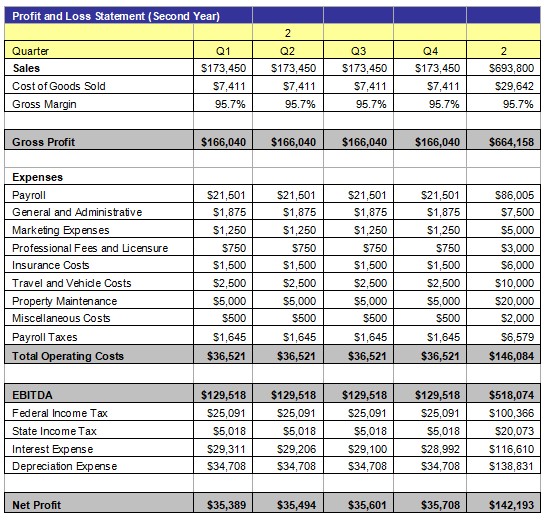

7.4 Profit and Loss Statement

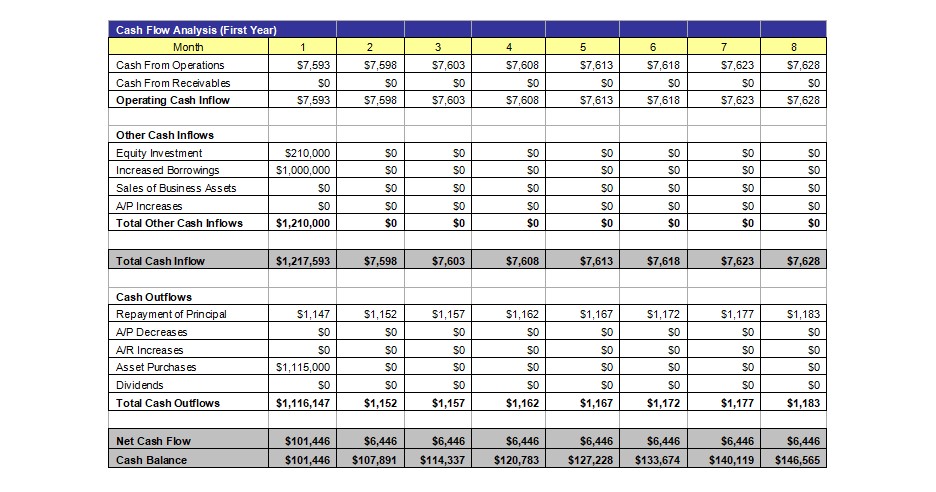

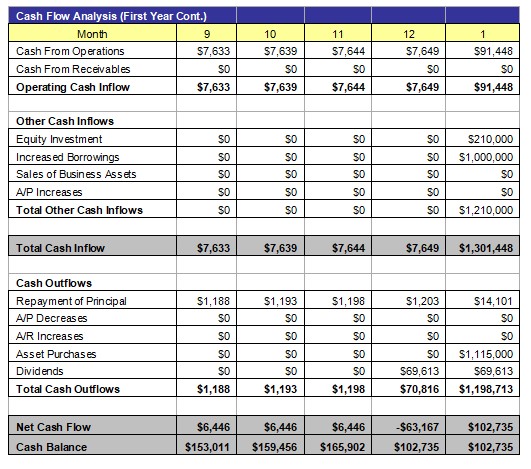

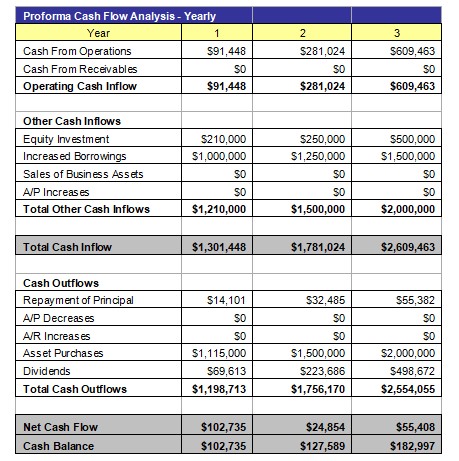

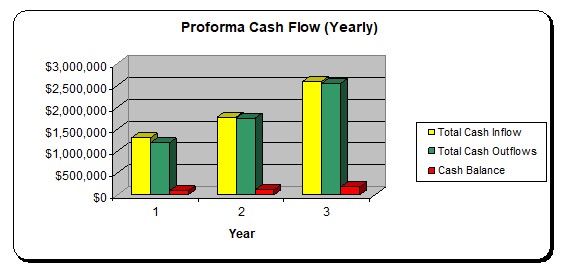

7.5 Cash Flow Analysis

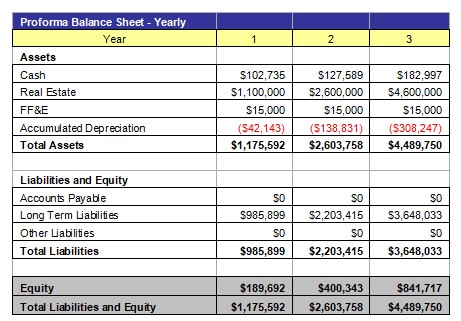

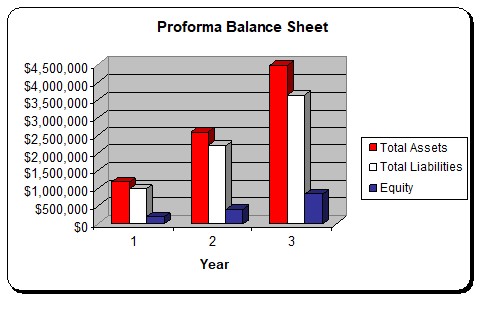

7.6 Balance Sheet

7.7 Breakeven Analysis

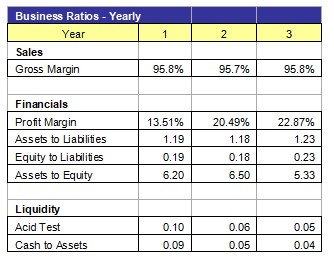

7.8 Business Ratios

Appendix A – SWOT Analysis

Strengths

- Economically insulated business as people are always going to require residential real estate.

- High gross margins from ongoing rental with minimally anticipated renter default (as a result of substantial credit review checks in place).

- Recurring streams of revenue on a monthly basis.

- A Founder-Operator (John Doe) that has extensive experience in the real estate investment industry.

Weaknesses

- Many regulatory and compliance issues.

- Legal liabilities resulting from accidents within owned buildings.

- Competitors within the same New York metropolitan area market.

Opportunities

- Expansion of the business to maintain several properties.

- Attract additional equity capital from private equity firms and angel investors.

Threats

- Errors and omissions can cause serious legal liability for Real Estate Investment Firm, Inc.

- Many other businesses targeting the same clientele.

- Liabilities resulting from onsite renter injury can severely damage the Company.

Appendix B – Expanded Profit and Loss Statements

Appendix C – Expanded Cash Flow Analysis