1.0 Executive Summary

The purpose of this business plan is to raise $300,000 for the development of a property rehabilitation firm while showcasing the expected financials and operations over the next three years. The Property Rehabber, Inc. (“the Company”) is a Texas based corporation that will acquire residential properties with the intent to fix them and resell them into the open market. The Company was founded by John Doe.

1.1 The Operations

The Company will be actively engaged in the acquisition of properties throughout the State of Texas that are in need of substantial renovation prior to their sale or rent to a third party. Property Rehabber, Inc. will focus on developing ongoing relationships with real estate investors that will generally acquire rehabilitated properties after their completion. The business will also maintain an expansive marketing apparatus for marketing these units for sale to the general public (in conjunction with a retained real estate brokerage).

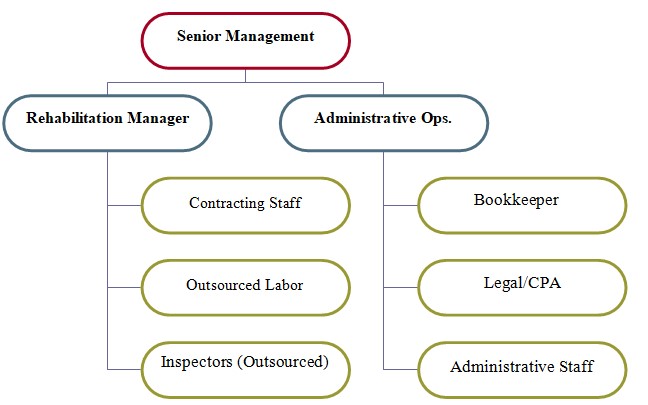

Management intends to acquire properties that are usually 30% to 70% under their fair market value. The business will have a number of inspectors on retainer so that the Company can know what specific issues must be addressed in order to bring the property to saleable condition. The Company will also have a through inspection of each property completed (among a number of different contracting disciplines) to ensure that there are no unexpected issues during the course of a renovation.

The third section of the business plan will further describe the services offered by the Property Rehabber.

1.2 Financing

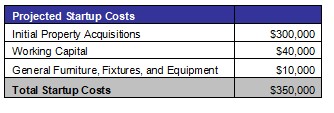

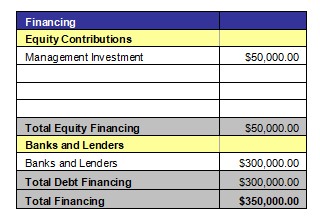

Mr. Doe is seeking to raise $300,000 from as a bank loan. The interest rate and loan agreement are to be further discussed during negotiation. This business plan assumes that the business will receive a 10 year loan with a 6% fixed interest rate. The financing will be used for the following:

- Capital to acquire properties for renovation.

- Financing for the first six months of operation.

- Capital to market the properties for sale to the general public.

Mr. Doe will contribute $50,000 to the venture.

1.3 Mission Statement

Management’s mission is to develop Property Rehabber into a premier property rehabilitation firm in the Texas and Midwestern US market.

1.4 Management Team

Mr. Doe is a veteran contracting professional that will be able to properly manage all aspects of property rehabilitation while quickly bring the operations of this business to profitability within the first year of operations. His biography can be found in the sixth chapter of this business plan.

1.5 Sales Forecasts

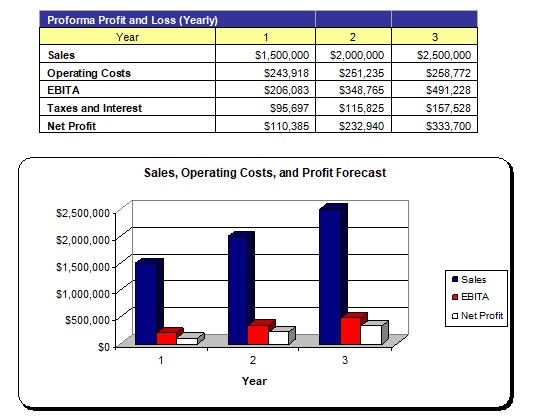

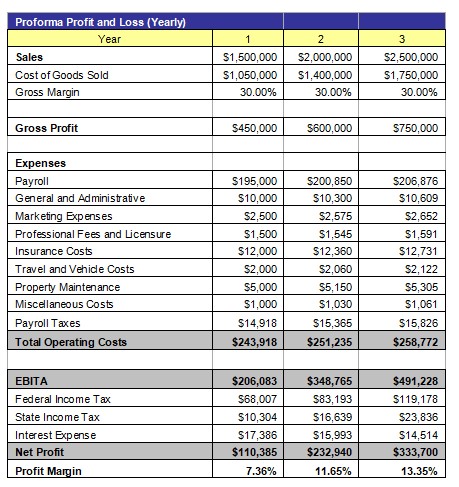

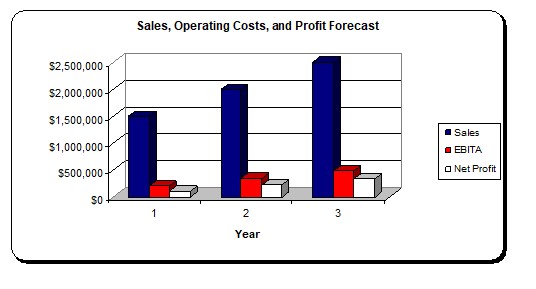

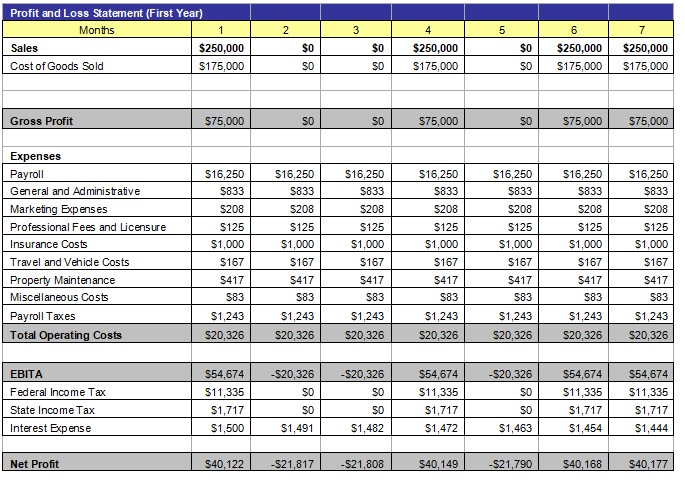

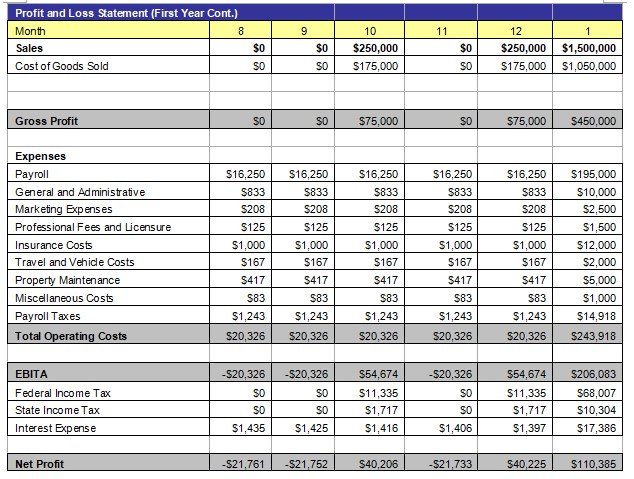

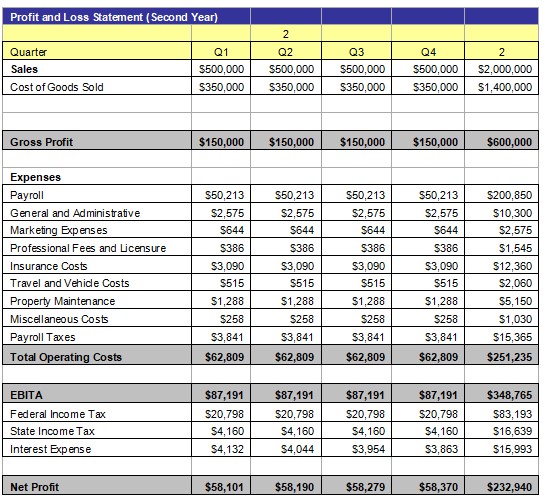

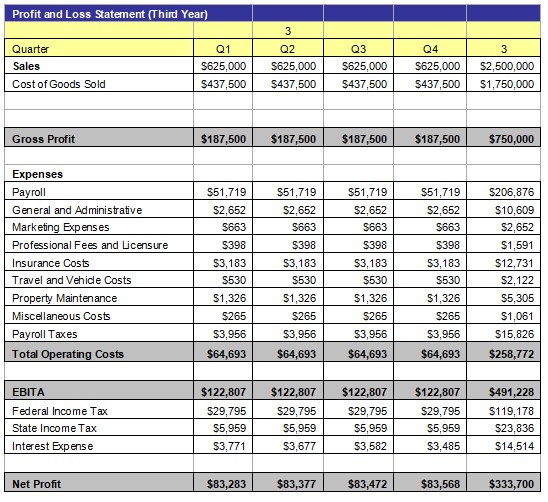

Mr. Doe expects a strong rate at the commencement of operations. Below are the expected financials over the next three years:

1.6 Expansion Plan

The Founder expects that the business will aggressively expand during the first three years of operation. Mr. Doe intends to complete a number of property rehabilitations during the next three years while heavily reinvesting the Company’s positive cash flow into new projects.

2.0 Company and Financing Summary

2.1 Registered Name and Corporate Structure

Property Rehabber, Inc. The Company is registered as a corporation in the State of Texas.

2.2 Required Funds

At this time, the Property Rehabber requires $300,000 of debt funds. Below is a breakdown of how these funds will be used:

Mr. Doe will make a $50,000 capital injection into the Company.

2.3 Investor Equity

Mr. Doe is not seeking an investment from a third party at this time.

2.4 Management Equity

John Doe owns 100% of the Property Rehabber, Inc.

2.5 Exit Strategy

As each real estate deal is completed separately, Management has not outlined a concrete exit strategy. In the event Mr. Doe wishes to retire or cease business operations, he will most likely contract a real estate brokerage to divest the Company’s current assets and the Property Rehabber entity will dissolve.

3.0 Operations

As stated in the executive summary, Property Rehabber, Inc. will be actively involved with the acquisition of properties that are substantially undervalued due to improvements that are needed. The business will work with a litany of third party contractors and inspectors in order to ensure that any specific rehabilitation can be carried out profitably. Mr. Doe has been actively building a large scale database of real estate agents and brokers that will source undervalued properties on behalf of the Company.

For project undertaken by the business, Management anticipates that it will take two to three months in order to complete the renovation. The Company will strive to achieve a return on investment of at least 50% on all acquisitions and rehabilitations. Generally, the Company will acquire properties that have an initial sales price of $100,000 to $150,000 with the anticipation that the properties will be sold for $175,000 to $250,000 upon their completion.

It should be noted that Property Rehabber, Inc. will generally use its own in-house construction personnel. Certain renovation and rehabilitative functions will be outsourced (primarily electrical work). At all times, Property Rehabber, Inc. will maintain all proper licenses, construction permits, and insurance policies. Mr. Doe has retained an attorney that will work on behalf of the business as it relates to general legal counsel regarding construction activities as well as for the legal aspect of buying/selling properties.

As it relates to targeted properties, the Company will focus its acquisitions on condominiums, single-family homes, duplexes, and triplexes. The Company will expand its operations over the next three years to include small-scale apartment buildings and multifamily residential properties. Property Rehabber, Inc. may seek to acquire additional rounds of capital from an investor in order to carry out large scale rehabilitations within the next three years. However, this business plan assumes that no further capital will be used and that all future growth will be financed via the retained earnings of the Company.

4.0 Strategic and Market Analysis

4.1 Economic Outlook

This section of the analysis will detail the economic climate, the real estate industry, the customer profile, and the competition that the business will face as it progresses through its business operations.

Currently, the worldwide economy is facing a number of uncertainties due to Covid-19. As a result of lower economic activity, interest rates have fallen substantially as people/businesses have cut back on expenditures. For real estate, there are now a number of new properties on the market (among people that are looking to sell properties rather than face foreclosure). This has created a number of buying opportunities among firms that have access to capital and want to acquire undervalued properties (especially those needing a moderate amount of renovation). It should be noted that many of the new single family, condo, and multifamily properties that are now being listed for sale were previously used for short-term vacation rentals. Many owner-operators of these firms are quickly looking to divest these properties given the waning demand for vacation travel (especially among investors that overleveraged their operations over the past four years).

However, the current economic climate should not impact Property Rehabber, Inc.’s ability to generate revenues. The business, as thoroughly discussed in this document, will acquire properties that are substantially undervalued. Additionally, the low interest rate environment will allow third party real estate investors (as well as potential buyers that will acquire a property as their primary residence) to affordably purchase these completed units.

4.2 Industry Analysis

The U.S. Economic Census estimates that there are 7,400 firms that specialize in the renovation of existing real estate units in the United States. Each year, this industry generates in excess of $14 billion dollars in aggregate gross incomes. Additionally, the business employs over 58,000 employees (does not include independent construction workers).

The growth rate of this industry is expected to mirror that of the economy as a whole. It should be noted that it is expected that there will be a flurry of activity over the next twelve to twenty-four months as the economy undergoes a correction as a result of the Covid-19 pandemic.

4.3 Customer Profile

Among individuals that will purchase completed properties as their primary residence, Management has developed the following demographic profile that will be used in conjunction with marketing operations:

- Annual household income of $50,000 to $100,000

- Has a budget of $175,000 to $250,000 for the acquisition of a home

- Has a down payment of 5% to 20% for their purchase.

- Will require a mortgage.

Among real estate investors that will purchase properties from the Company on an ongoing basis, the following individuals/companies will be targeted:

- Maintains a current portfolio of residential real estate valued between $2 million to $15 million

- Will generally cash (or a line of credit) to acquire properties without requiring a mortgage for acquisition

- Seeks to acquire single family and small multiunit residential properties

4.4 Competition

Given the free market nature of real estate, Property Rehabber, Inc. will face competition from general contractors, other property rehabilitation firms, and individuals that engage in this type of activity. One of the ways that the Company will remain competitive in this market is by maintaining a low cost operating and overhead infrastructure that will allow the business to remain flexible on pricing at all times.

Additionally, the business will use modern styling in all properties rehabilitated. The Company will retain an interior designer that will allow each completed property to have substantial appeal among potential buyers.

5.0 Marketing Plan

Property Rehabber, Inc. will use a number of marketing strategies in order to ensure that the Company can divest its rehabilitated units within one to three months of their completion. Below is an overview of the strategies that will be used by the Company over the life of the business.

5.1 Marketing Objectives

- Develop and maintain connections with real estate investors that will immediately purchase completed units.

- Retain a qualified real estate brokerage that will market properties to the general public when necessary.

- Maintain an expansive online presence that showcases in development properties.

5.2 Marketing Strategies

Foremost, Property Rehabber, Inc. will maintain strong relationships with Texas based real estate investors that will continually acquire properties that will then be rented to tenants. By partnering with these investors, the Company will be able to ensure a free flow of capital once a property is ready for sale. Mr. Doe has been actively working with real estate investors for many years, and he will call on these contacts to expand these relationships.

As it relates to online marketing, the Company will maintain an expansive website that showcases completed properties (including prior work of the business), properties that are currently under rehabilitation, the business’ contact information, and other pertinent information regarding Property Rehabber, Inc. This website will be search engine optimized and mobile friendly.

The Company will also maintain a presence on social media platforms including Facebook, Twitter, Instagram (for photos), and YouTube (for video). When a property is completed, images and video tours of the property will be placed on these platforms. This will further create interest among potential homebuyers.

Additionally, for properties that have been recently completed (but not yet under contract) – Property Rehabber will list these properties on popular real estate sales focused platforms. This will shorten the lead time between completion and sale.

In order to further drive sales of units to the general public, the Company will maintain relationships with local and regional real estate brokerages (and their associated agents). Property Rehabber, Inc. anticipates that commission rates will be 3% to 5% for each completed property.

6.0 Organizational Plan and Personnel Summary

6.1 Corporate Organization

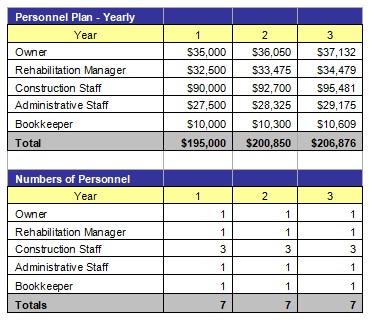

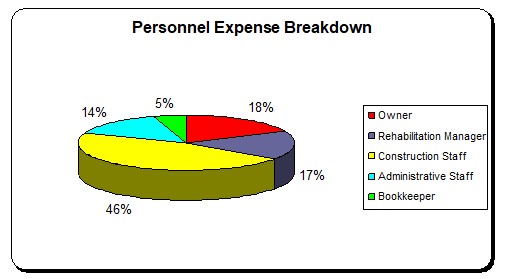

6.2 Organizational Budget

7.0 Financial Plan

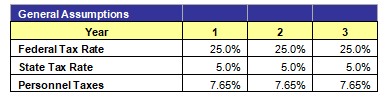

7.1 Underlying Assumptions

The Company has based its proforma financial statements on the following:

- The Property Rehabber will have an annual revenue growth rate of 29% per year.

- The Owner will acquire $300,000 of debt funds to develop the business (carrying a 10 year term and a 6% interest rate).

- The Founder will contribute $50,000 towards the business.

7.2 Sensitivity Analysis

Property Rehabber, Inc.’s revenues are moderately sensitive to negative changes in the economy. As has been discussed throughout this document, the business intends to focus its operations on the acquisition of distressed and heavily discounted properties that need a moderate amount of improvement. This will provide the Company with a substantial financial cushion as it progresses through its operations. This, coupled with the strong gross margins generated from each sale, will ensure that the Company can remain profitable and cash flow positive at all times. It should be noted that Property Rehabber, Inc. will generate instant equity in each completed project.

7.3 Source of Funds

7.4 General Assumptions

7.5 Profit and Loss Statement

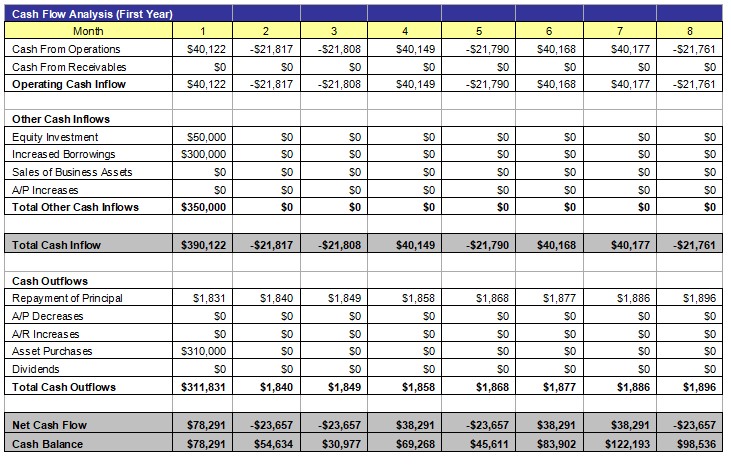

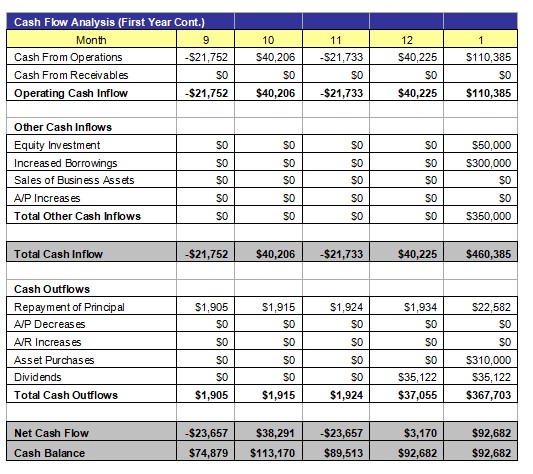

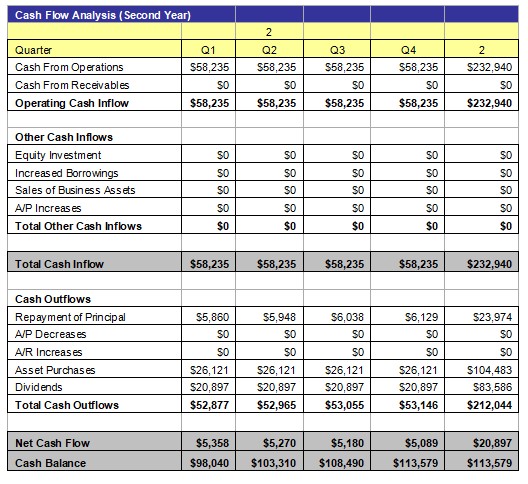

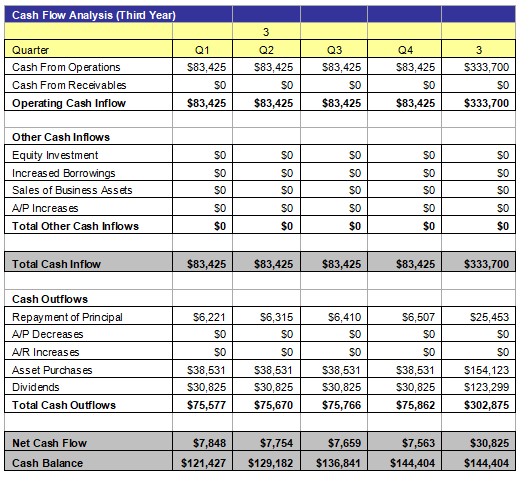

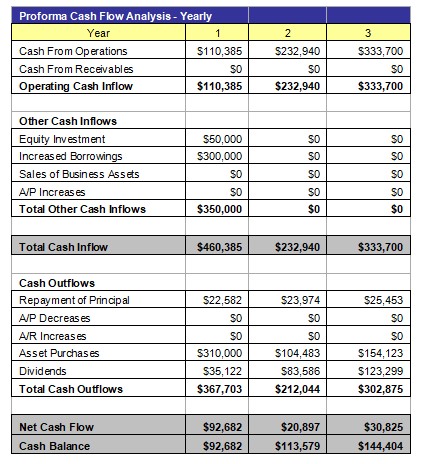

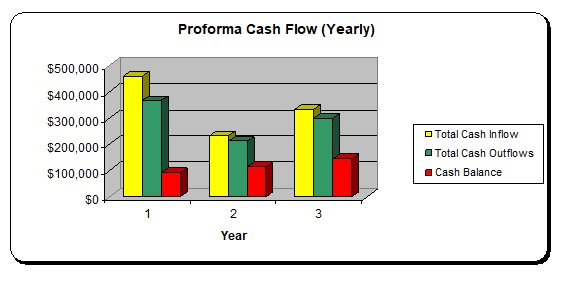

7.6 Cash Flow Analysis

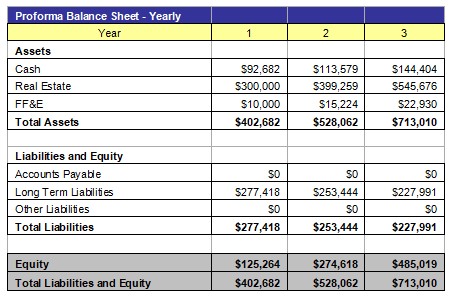

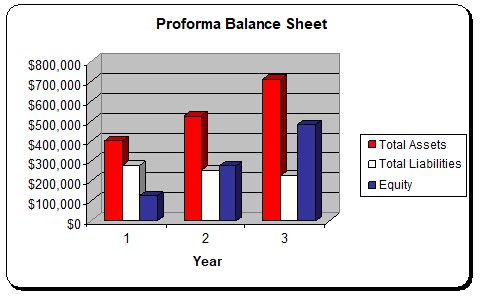

7.7 Balance Sheet

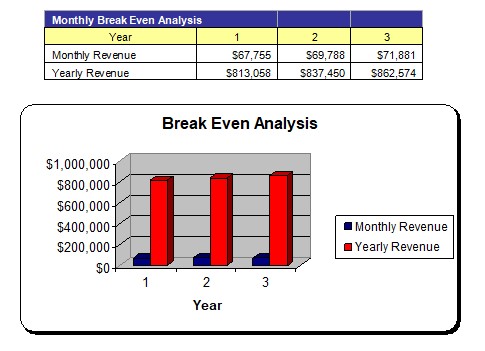

7.8 Breakeven Analysis

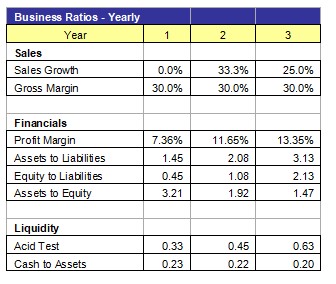

7.9 Business Ratios

Appendix A – SWOT Analysis

Strengths

- The ability to create substantial equity in each project upon its completion.

- Ongoing relationships with real estate investors will allow for a short lead time between completion and sale.

- Moderately low operating and overhead costs as a function of revenues.

- A highly experienced owner-operator (John Doe) that has years of experience in the contracting and construction industry.

Weaknesses

- Rapid changes in the economic climate can impact of the operations of the business.

- Property rehabilitation requires a substantial upfront investment.

Opportunities

- Potentially rent certain completed units in order to produce a recurring stream of revenue for the Company.

- Acquisition of additional rounds of debt capital in order to further fuel growth.

- Syndication of equity capital that would allow Property Rehabber, Inc. to complete renovations and rehabilitations on larger scale residential and commercial properties.

Threats

- Continued economic uncertainty as a result of the pandemic.

- Other companies competing to sell their units among real estate investors and homebuyers.

Appendix B – Expanded Profit and Loss Statements

Appendix C – Expanded Cash Flow Analysis